Australia is the West’s last best model.

Such was the declaration of George Megalogenis in his book, The Australian Moment, published in February 2012.

There’s little question that Australia has had a good run over the past quarter of a century. We graduated from an middling developed economy to be one of the most prosperous nations on Earth; from 1991 through to 2014, Australia’s income per capita rose from 20th in the world to 6th. We boast an educated, multicultural workforce, sound institutional and regulatory frameworks, and a great abundance of vital natural resources. As with all economies, Australia has weaknesses, but surely these were put to the ultimate test in 2008/09 as financial crises ripped through the global economy? And yet still our recession-free run remained unbroken.

The central thesis of The Australian Moment is that Australia distinguished itself from its developed-world peers through a pragmatic commitment to economic rationalism; deregulation and global engagement without financial sector debauchery. For the most part it’s a worthy book. Drawing on the recollections of past prime ministers, and insisting that they focus on the merits of their successors and/or predecessors (a request Keating simply could not abide), Megalogenis presents a sound history of Australia’s post-Menzies reform agenda and the reorientation of Australia’s key economic partnerships away from Europe and North America, and towards Asia.

When he reaches the new millennium, Megalogenis is correct, in my view, that Howard and Costello failed to advance the cause of reform beyond the GST and handed out too great a share of windfall tax revenues, embedding a structural deficit in the federal budget. He also recognises that household debt ballooned excessively, and that our infatuation with property is a wasteful use of capital. Nevertheless, instead of concluding that Australia squandered much of the boom, which seems the logical result from his analysis, Megalogenis reaches the opposite conclusion: Australia is the West’s last best model.

This honour, this Australian moment, is bestowed by Megalogenis mainly for what he sees as our finest hour: a vigorous and rapid deployment of government stimulus to beat back the menace of global recession in early 2009. This left Australia the stand-out among wealthy nations; a model to be emulated.

The recession we didn’t have to have

The question everyone asks us is: ‘How did you guys do it?’

According to Megalogenis, this was what Australia’s politicians and officials heard in the aftermath of the crisis, as shellshocked policymakers from less nimble nations tried to make sense of the carnage.

In fact, as articulated by Treasury Secretary Ken Henry, the magic formula was not especially esoteric: ‘Go early, go hard and go households’. Rudd went harder. In October 2008, a day short of a month after Lehman Brothers filed for bankruptcy, the first wave of stimulus was announced. It consisted of a $10 billion ‘cash splash’ to get folks spending through Christmas, a doubling of the first homeowners grant for existing homes, and a trebling for new homes. This was followed by a second round of cash payments in February 2009 and a $28 billion commitment to public investment, with the largest initiative being the school buildings program. In addition to fiscal stimulus, Australia’s monetary authorities responded decisively. Between March 2008 and April 2009, the RBA slashed the cash rate from 7.25% to 3%. Partly because of this, the Australian dollar went into freefall, losing close 40% of its value against the US dollar between June and October 2008.

Australia dodged a technical recession in 2009, and recorded much stronger growth and lower unemployment in subsequent years than most developed economies.

Despite this performance, the economic sense of the Rudd/Swan stimulus packages has been the subject of intense (and intensely politicised) debate. This isn’t my primary interest here. The question I’m addressing is: Was the stimulus of such importance to Australia’s economic performance that it set the ‘Australian model’ apart internationally? Was Australia’s success mainly due to something Australia did that other nations didn’t do? Or was it something the global economy did to Australia which is didn’t do to others?

Crash or splash

With regards to household behaviour, the stimulus basically achieved its ends. In 2009, when consumer spending was sliding across much of the globe, Australian retail sales registered a comparatively healthy bounce. The cash was splashed.

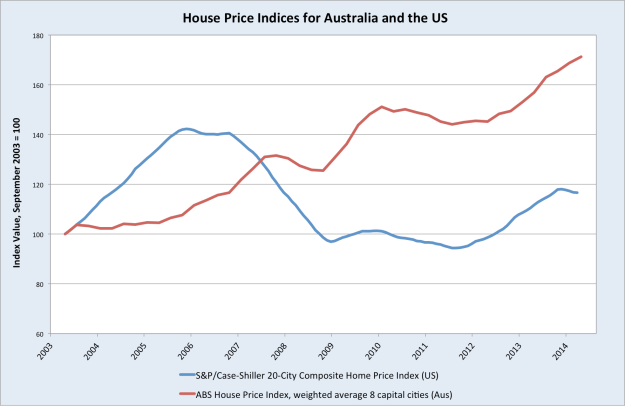

The boost to the first homeowners grant also produced the desired effect. Australia has expensive houses and highly leveraged households, making us vulnerable to housing shocks. For a few fretful months it appeared that local house prices might follow America’s into the dirt. Thankfully it was not to be.

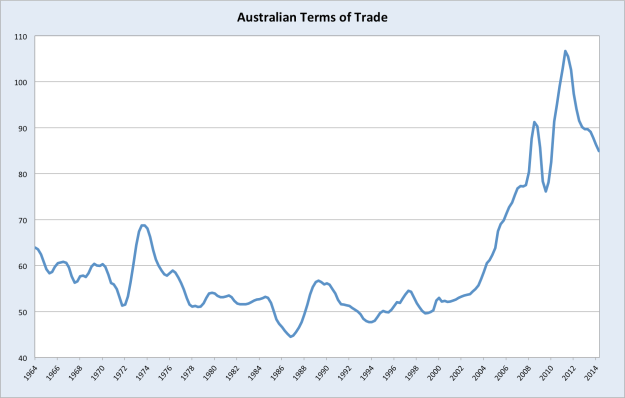

Along with the first homeowners grant, the massive reduction in interest rates obviously added substantial support to house prices in 2009. Which was greater in overall effect I cannot say, but the fact that we avoided material falls in house prices, and instead notched up solid gains, further buttressed consumer confidence and spending, particularly in NSW. Therefore, I do think it’s fair to say that the stimulus shielded the economy in the immediate aftermath of the 2008 crash, particularly in light of the decline in the terms of trade, which continued through to September 2009. (The terms of trade is a ratio of export prices to import prices; how many Hondas we receive for a shipload of coal, basically.)

That the terms of trade was a drag on national income during 2009 leads many commentators, Megalogenis among them, to reject the argument that the external sector was Australia’s true saviour after the crash. From his book:

One of the myths that has developed since, and which is reinforced by public opinion polls, is that China saved us. But China had a bigger slowdown that the United States in the first half of 2009. Australia’s terms of trade fell for four quarters in a row from the December quarter 2008 to the September quarter 2009. The quarry was’t as important as people thought.

Not for a few months in 2009, perhaps. But what would have happened if the terms of trade continued to nosedive? What would have happened if the resource sector slashed capital expenditure? It may have subtracted from growth in 2009, but the resource sector very quickly reapplied the throttle. And of course, this turnaround owed little to the recession-fighting prowess of Australia’s policymakers.

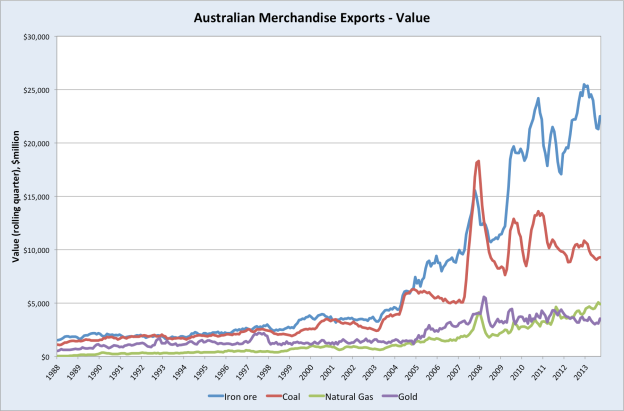

Examining our key export commodities in further detail, we get a deeper impression of their contribution.

Clearly iron ore became the stand-out performer from 2009 onwards, far exceeding its pre-crisis contribution to the economy. China’s response to contracting global trade didn’t just consist of a sizeable central government stimulus package; more importantly the government (by way of the central bank) flooded the economy with credit to fund a gargantuan infrastructure and property boom. This was big enough to cover the decline in foreign demand for Chinese exports, and then some. To pull this off, China sucked in raw materials voraciously. Thus the spot price of iron ore exploded, sending our terms of trade and export earnings up with it. (Note: the following chart doesn’t capture the large jump in spot prices shortly before to the 2008 crash, which contributed to the spike in iron ore earnings in 2008. Spot prices are only depicted from 2009 on.)

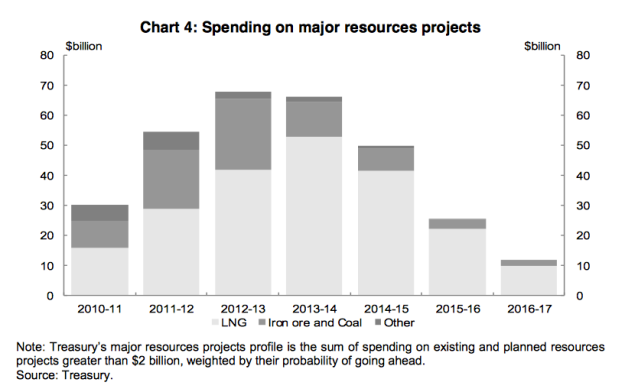

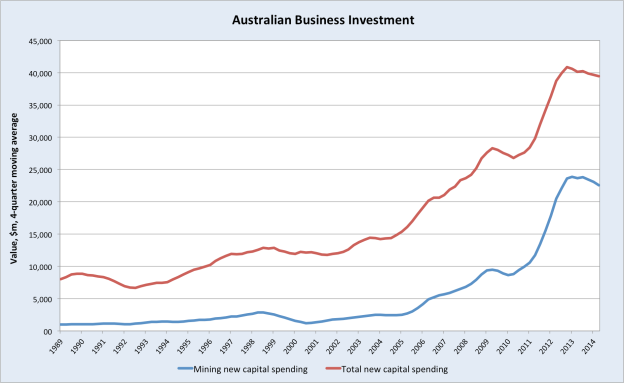

Even more significant than the swift rebound in export earnings, I would argue, was the arrival of an investment boom in the resource sector. As late as 2007, Santos, Oil Search and ExxonMobil were intending to pipe gas from PNG into the Australian market. As coal seam gas emerged as a substantial source of domestic supply, this plan was abandoned and reworked into an LNG project (which was switched on a few months ago). This decision, and of course the promise of robust Asian demand, triggered something of an LNG arms race. As far as I know, at its peak there were 13 projects planned across Australia (some of which have since been shelved), valued at around $220bn. A flurry of capital spending began to take effect in 2010, shortly after the terms of trade turned higher. In addition, substantial investment took place in iron ore capacity expansions.

The timing of the investment boom was impeccable, greatly adding to private business investment at a time when it was all but dead across the developed world. Business investment is typically the most volatile aggregate spending component, and usually exacerbates business cycle fluctuations, so bucking this trend was critical to Australia’s post-crisis performance.

Had neither of these fortuitous developments occurred, there’s little that Australian policymakers could have done to ward off a much more painful downturn. Although domestic demand was successfully supported during 2009, Australia could not have leveraged its public balance sheet to fund private consumption indefinitely, nor could we have got by on higher house prices for all that long if our export earnings were tanking and our labour markets suffering. (We’re testing the practical limits of this strategy right now, actually!)

We must also consider that the Australian economy’s fundamentals were relatively healthy when the crisis hit. Unlike the US or the UK, where leverage and housing bubbles were the chief propellants of economic activity, Australia was at least riding a legitimate terms of trade boom. This meant that aggressive measures to stimulate consumption spending and invigorate the housing market were far more effective in Australia than they were in economies which for years had already been almost entirely reliant domestic bubbles for ‘growth’. Moreover, the level of the terms of trade and the Australian dollar in 2008 meant that Australia’s currency depreciation was particularly potent, supporting profits and jobs without delivering an overly traumatic shock to household purchasing power (since the nominal exchange rate had reached such a high level before it fell).

So while I don’t deny that the stimulus had an impact, more important forces took precedence in fairly short order. The stimulus probably wasn’t bad policy at the time, no one really knew how bad things were going to get in early 2009, but Australia’s economic performance over the past 5 years has been overwhelmingly driven by international trends beyond the control of its policymakers. The Australian moment identified by Megalogenis simply wasn’t replicable in most developed countries (Norway and Canada are probably the only close analogues).

So if we’re to uncharitably deprive Australia’s technocrats and politicians their a moment in the sun, should we discard the notion of an Australian moment altogether?

Clearly not, for two reasons. Firstly, the boom was one of the biggest, if not the biggest commodity boom we’ve experienced. It was a hell of a moment! Secondly, a complacent confidence that the boom would underwrite Australia’s long-term prosperity pervaded both industry and policymaking circles, and for that reason we should pay heed to the siren song of Australian Exceptionalism.