The property market is booming. Residential construction is running hot. Consumers are stoked. The labour market is healing.

Might it finally be time to recognize that the economy has turned a corner and the next change to monetary policy will be a rate hike?

That’s the feeling that emerged last week among the nation’s rate watchers:

Goldman: We now believe that the most likely scenario is that the RBA keeps rates unchanged at 2.00% through 2015 and into 2017.

ANZ: Perhaps the labour market is even better currently than we thought. If so, achieving a cash rate cut by February looks less likely at this stage.

UBS: Hence, the odds of the RBA cutting have sufficiently shifted that we today change our view and now expect the RBA to remain on hold ahead (rather than cutting by 25bp in February).

AMP: As a result a December rate cut is now very unlikely and while I still lean to another rate cut early next year, it’s now a very close call, and we would need to see some softer economic data in the interim.

This shift in outlook was born of two key releases.

Firstly, last Wednesday we saw a solid bounce in the Westpac Consumer Sentiment Index, lifting 3.9% and signalling a healthy year for Christmas spending.

From a beaming Bill Evans:

This is a cracking result. Apart from the brief surge we saw following last May’s Budget this is the highest print for the Index since January 2014. The Index is now 8.3% higher than in September, immediately preceding the change of leadership in the government.

It marks only the third month out of the last twenty one that optimists have outnumbered pessimists.

Then on Thursday we were treated to a rollicking Labour Force survey, with jobs surging a somewhat suspicious 58,600 in seasonally-adjusted terms, sending the unemployment rate down to 5.9% from 6.2% in September.

This result was largely driven by a big drop in Victoria’s unemployment rate, from 6.3% to 5.6%, with roughly 26,000 new jobs added during October in seasonally-adjusted terms.

Weirdly, the unemployment rate for WA jumped from 6.1% to 6.4% over the month, in itself not surprising given the parlous state of the West; however this occurred despite a strong increase in total employment, as seen above.

Statistical incongruities aside (detailed here by Westpac’s Justin Smirk), the labour market has undoubtedly improved over the past year, with NSW the star performer.

A New Growth Engine

The structural weaknesses plaguing the Australian economy should by now be well-known. We are in the advanced stages of a massive, ‘once-in-a-century’ mining bust, which is rapidly draining our national income. Moreover, the juiciest phase of the boom in terms of domestic expenditure, the post-GFC resource sector investment surge, is also retreating fast.

So what accounts for the relatively sprightly state of the labour market?

The lower dollar is playing its part, helping sectors like manufacturing and tourism.

Indeed, given the decline in the Aussie dollar, it’s perhaps surprising that tourism has not enjoyed an even greater boom. This I think can be partly attributed to the unusually long period of Aussie dollar strength, which entrenched in Australians a preference for overseas holidays. Plummeting South East Asian currencies may also be playing a part, keeping it cheap to visit our neighbours to the north.

In any case, while the uplift in non-mining tradable industries is welcome, the élan vital of the Eastern states is undeniably the property sector.

House prices have rocketed in Sydney and Melbourne over the past couple of years.

Driven by a frenzy of speculative buying.

Although much of this finance is directed towards the purchase of established dwellings, the latest boom has at least been been accompanied by a strong rise in residential construction, particularly of apartments, some which may even be safe enough to live in.

This growth in mortgage lending, house prices and construction has increased employment and boosted consumer confidence, which has in turn supported retail spending, especially on higher-value goods such as automobiles.

The Engine Sputters

How has this property boom come about? There are a number of contributing factors in this country that act to exacerbate the pace of house price inflation, but ultimately the trigger lies in the hands of the RBA. Low interest were the spark that ignited this bonfire, and are the fuel that keeps it burning.

However, it is important to recognize other contributing factors, for the more conducive the wider environment is to rising house prices, the less monetary easing will required to sustain momentum.

Chief among these factors are:

- A legacy of undersupply/inelastic land supply

- Strong population growth

- Tax incentives favouring residential real estate speculation

- Foreigner investor demand

- Regulatory insouciance

Looking at each factor individually, we can see evidence of waning support for property price growth going forward.

The second factor, population growth, is obviously closely linked to the first. Unresponsive housing supply is more likely to lead to strong growth in prices when fundamental demand is strong.

Driven by soaring immigration from the inception of the mining boom in 2004, Australia’s population growth has boomed over the past decade, notwithstanding the swoon following the GFC. As this resource sector boom has subsided, eroding employment prospects, population growth has trended lower.

Combined with the sharp increase in residential construction evident on the previous Building Approvals chart, Australia’s housing shortage is beginning to disappear. The telling indicator on this score is growth in rents, which are not exposed to the speculative bid and therefore a better indication of fundamental demand than house prices.

Below is a snapshot from Core Logic’s October Rental Index release.

Plainly, demand for accommodation in this country is not running into any noteworthy supply constraints. As population growth continues to slow, and as new supply enters the market, especially in Sydney and Melbourne, we are likely to see rents cool further. This in itself does not augur lower prices; valuations can always get sillier, but it does make future appreciation a tougher ask for investors, who must wear lower cash flows as they await capital gains.

Tax incentives centre on the capital gains tax discount and negative gearing. Maybe they’ll be under consideration as part of the government’s tax reform program? Maybe I’ll be saying that to my grandkids. Although Australia’s tax regime encourages property speculation, for our purposes it’s not a particularly important consideration. Given the other headwinds, the failure to reform negative gearing, for instance, isn’t going to be the deciding factor holding the market aloft.

Foreign investor activity, on the other hand, most certainly is a pertinent consideration. Foreign buyers have been instrumental in this boom. Owing to macroeconomic settings in China since the GFC, a very large share of foreign buyers do happen to be Chinese. This is a global phenomenon, witnessed in large cosmopolitan cities across Europe and North America.

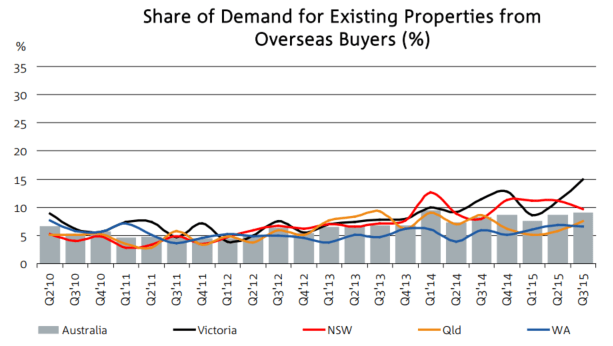

In Australia, the main markets of interest have unsurprisingly been Sydney and Melbourne. These charts, taken form NAB’s most recent quarterly Residential Property Survey, illustrate the scale of foreign investor participation in the these markets, Melbourne especially.

This activity is under attack on two fronts. Firstly, the Chinese government would like the freedom to ease monetary settings without seeing their FX reserves evaporate combating capital flight. As such, Beijing is tightening the channels by which capital seeps through their supposedly rigidly-controlled capital account. Secondly, Australia is bringing in new foreign investment rules from December 1, with tougher penalties for illegal purchases.

Real estate agents began reporting reduced foreign buyer interest towards the end of the third quarter, and although it’s certainly too early to write the obituary of the Chinese bid, the loss of what has recently been a key segment of market is a negative for prices.

For all the other factors we’ve considered, the most important driver of this boom has been domestic investors. As we’ve seen, investor mortgages have exploded over the past three years in the key states of NSW and Victoria. Many lay the blame at the feet of the RBA for this phenomenon, and while I agree that low interest rates were the trigger, this assessment is incomplete. It has been low interest rates coupled with regulators’ failure to get out in front of the market with tough macroprudential regulations, that resulted in the orgy of speculation. There were sound arguments for reducing interest rates, but not for reducing them without an adequate regulatory regime for controlling runaway speculation.

Although two years too late, APRA and the RBA did eventually recognize the beast they had unleashed, and have taken measures to contain it. Partly the result of these measures, the growth in investor mortgage issuance is been declining.

Drawing together the effects of deteriorating rental yields, roadblocks to foreign investors, and tightening domestic credit conditions, auction clearances have descended.

And price growth is sliding, particularity in NSW, the all-important leading market.

With all these factors in play, it is hard to see falling house prices arrested except by the deft hand of our monetary overlords.

Because the housing boom forms the backbone of Australia’s essential growth engine at present, it is highly likely that the RBA will be compelled to cut interest rates next year. With support for the market falling away from all sides, the only way to buttress it will be by lower interest rates. And buttressed it must be. Without the property boom, all we have is the aftermath of the worst commodity rout in living memory.

So in fact my argument remains substantively unchanged from a year ago, when I could count far fewer analysts sharing my view that interest rates would fall early in the new year: The only justification for not cutting rates, the robust property market, cannot be sustained except by lower rates.

My expectation for the past few months has been that the RBA would cut in February. Recent healthy data, along with a solid pipeline of residential construction projects, may postpone this by a month or two, but once again it is a question of when, not if, interest rates will be cut.