Crossing over from ‘Straya to ‘Murica for a moment.

American conservatives have lined up to condemn the monster they honestly didn’t mean to create.

The National Review has been on a war footing since January. Erick Erickson has spearheaded an anti-Trump coalition, Glenn Beck doesn’t think he’s a real conservative, feminist vanguard Fox News is outraged by his free-wheelin’ misogyny.

The challenge for this well-mannered anti-Trump alliance is that central tenets of the modern conservative movement remain inherently pro-Trump, in that they pro-actively exacerbate the social trends coursing beneath the Trump phenomenon.

Kansas went strongly to Cruz in the primaries, but the economic experiment carried out by Governor Sam Brownback offers lessons for the conservative movement at the national level.

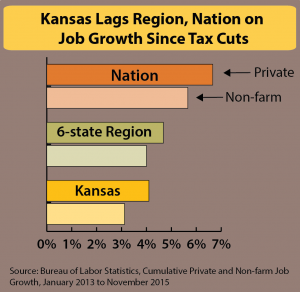

From 2012, Brownback- who bears the distinctive look of a man satisfied by the sight of homeless people- implemented a “real-live experiment” in extreme-right tax policy. Income taxes were slashed. Brownback confidently proclaimed that this “new pro-growth tax policy will be like a shot of adrenaline into the heart of the Kansas economy.”

Since then unemployment in Kansas has indeed fallen, but by less than its neighbours and by less than the nation.

More importantly, this policy was expected to deliver the magical Laffer unicorn of rising-tax-receipts-via-lower-tax-rates. So much additional economic activity would be generated, it was alleged, that tax receipts would rise even though tax rates had been slashed. This is old hat supply-side voodoo economics of course, and was predictably doomed to failure: the budget is now utterly wrecked and the legislature in a state of intense dysfunction.

But perhaps this was the intention? Duane Goossen suspects so:

And state finances? What a mess. The revenue loss from the income tax cuts put the state budget drastically in the red. In response, lawmakers raised sales tax rates twice, which transferred more of the state’s tax burden to low-income Kansans but did not come close to correcting the budget imbalance. Lawmakers also blew through the state’s reserves and transferred hundreds of millions away from highways and children to barely eke out a budget.

But therein lies the secret to the “success” many lawmakers really sought. If you want to cut programs and force state government to be smaller, starving the revenue stream provides the easiest route.

And therein lies the pro-Trump engine lurking within the conservative agenda. Reducing income tax rates, especially when paired with rising consumption tax rates, shifts disposable income from the poor to the rich. Since America, along with much of the global economy, suffers from a chronic lack of demand, shifting after-tax disposable income from the poor to the rich not only exacerbates inequality but also weakens the economy over the medium to long term.

Kansans were capable of looking through the Trump mirage and instead opted for the more conventionally loopy Ted Cruz. And what of Ted’s tax plan? Slash ’em. Under his plan, lost revenue would run well into the trillions and gains would accrue disproportionately the rich:

In 2017, the proposal would cut taxes at every income level, but high-income taxpayers would receive the biggest cuts, both in dollar terms and as a percentage of income. Overall, the plan would cut taxes by an average of about $6,100, or about 8.5 percent of after-tax income.

However, the highest-income 0.1 percent of taxpayers (those with incomes over $3.7 million in 2015 dollars) would experience an average tax cut of more than $2 million in 2017, nearly 29 percent of after-tax income. Households in the middle of the income distribution would receive an average tax cut of $1,800, or 3.2 percent of after-tax income, while taxpayers in the lowest quintile would receive an average tax cut of $46, or 0.4 percent of after-tax income.

These cuts would necessitate substantial reductions in spending, with social security naturally first on the chopping block. We’ve known for decades that millions of Americans are prepared to support policies plainly contrary to their economic interests, and this hasn’t changed. The issue is that outcomes have signally failed to match promises. The GOP would be optimistic, not to say delusional, to believe it can continue pushing tax reform favouring the rich on to gullible voters, and have them revert back to the dignified obeisance they’ve supposedly discarded during this election cycle.

Of course, Trump the man offers no remedy. He’s merely an opportunistic, bellicose rabble-rouser, descended from a long line of adroit manipulators of public disaffection. Indeed, his tax policies are no different in effect from the rest. But Trumpism, that alarming groundswell of ugly popular anger, will only amplify the longer the conservative wing of American politics remains rigidly committed to policies that exacerbate social and economic disparities.